Are Rising Interest Rates Delaying Your Purchase?

With the increase in interest rates, many buyers are on the fence.

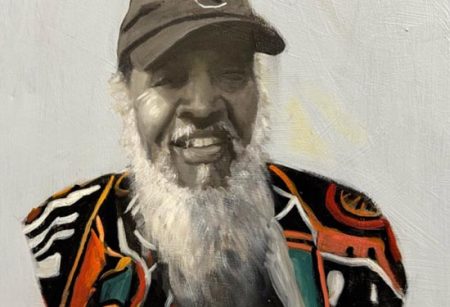

By Sandra Kilgore, GRI, ABR, SFR –

Interest rates have always played a crucial role in history in shaping our economy, which affects the real estate market.

If now the time to purchase a home, or should you wait for interest rates to drop?

Let’s start with a bit of history on interest rates. When I bought my first home in 1986, interest rates were in the 10-12% range.

In the 1970s and 1980s, due to economic uncertainties, rising interest rates and changes in monetary policies led to increased interest rates to slow economic growth. In the 1990s, interest rates generally trended downward. In 2008, the global financial crisis and the subsequent recession led to even lower interest rates.

Fast forward to today; rising inflation has increased mortgage interest rates from around 3% to 6% in the last year.

The increase in interest rates has pushed many buyers out of the market, while others who chose to buy have larger monthly payments. The decision is a tough one, very personal, and leaves us with very few options.

Do we continue to pay increasing rental costs, or do we purchase and enjoy homeownership and invest in our future economic growth?

If we wait, there are no guarantees when and if the interest rate will drop. If it does, you may have the option to refinance to a lower rate. Contact me today, I can help you explore your housing options.

Kilgore & Associates Real Estate

Sandra Kilgore GRI, ABR, SFR

Cell: 954-540-5593, [email protected]

AshevilleKARE.com

Asheville Kare Property Management

46 S. Market St., Asheville, NC 28801

828-356-5593, [email protected]

AshevilleKAREpm.com