Will Social Security’s 2026 COLA Offset Rising Everyday Costs?

Nearly three quarters of all seniors rely on Social Security for at least half their income.

By Charlene Crowell –

Medicare Part B premium increases will strain 22 million retirees whose sole income is Social Security.

As the federal government shutdown that began on October 1 continues, over 74 million citizens awaited an important but delayed announcement: Social Security’s 2026 Cost of Living Adjustment, also known as COLA. Originally planned for October 15, the 2026 COLA was finally announced on October 24. The increase in the earned benefit will be 2.7%; that slightly larger amount will likely be eaten up by larger increases in Medicare premiums.

The Social Security Administration is legally required to announce the annual COLA before November 1 each year to ensure timely implementation of the increase the following January. This year’s delay was caused by the need to complete the third quarter’s Consumer Price Index (CPI) report, which spans data for July, August, and September, an essential part of annual COLA calculations. Though the government has been shut down by partisan intransigence since Oct. 1, employees with the Bureau of Labor Statistics were called back for its completion.

“For many people, Social Security is the only inflation-protected income they have in retirement,” Bill Sweeney, AARP’s senior vice president of government affairs, says. “And for more than 50 years, the COLA has allowed America’s seniors to keep up as everyday costs continue to rise—from groceries to housing to prescription drugs.”

Yet for many retirees, this theory of keeping benefits in line with costs is not their reality. The proverbial “golden years” all too often are tarnished by financial strains due to rising costs that challenge older Americans’ financial stability.

Social Security alone is enough to cover the living expenses in only 10 states, according to the realtor.com analysis of median Social Security benefits by state and the Elder Economic Security Standard Index. Everywhere else, retirees face shortfalls that can be thousands of dollars per year.

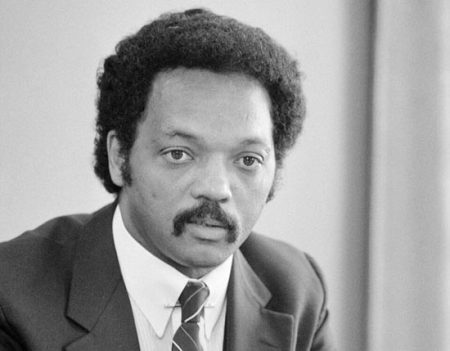

Nearly 22 million seniors are estimated to live on Social Security alone, according to a recent study by The Senior Citizens League (TSCL). The league also estimates that nearly three quarters of all seniors rely on Social Security for at least half their income, underscoring how important it is to understand the difference between living expenses and what Social Security can realistically cover.

“With nearly three quarters of seniors depending on Social Security for at least half their income, any cuts to the program or reductions in benefits would push millions of hard-working Americans further into poverty, robbing them of their right to retire with dignity,” says TSCL Executive Director Shannon Benton.

Additional findings from TSCL show 94% of respondents felt the 2025 COLA of 2.5% was too low and that their benefits grow more slowly than inflation. Nearly all respondents (95%) said reforming Social Security and Medicare should be a top priority for the presidential Administration and Congress.

The average monthly Social Security check for retirees was $2,008.31 this past August, as reported by Kiplinger. Further, state-by-state comparisons show that retirees receive in 26 states receive less. Beneficiaries in Kentucky, Louisiana, and Mississippi, for example, receive approximately $1,800 each month. Conversely, highest monthly benefits are received in Connecticut, Maryland, and New Jersey, with recipients in each state surpassing $2,100 each month.

A 2025 Social Security survey released in August by the Harris Poll and underwritten by Nationwide. Its findings included:

- Current benefit levels cover only 59% of seniors’ retirement expenses.

- 56% say they could not financially survive missing even half of the monthly payment.

- 52% have had to reduce discretionary spending due to rising living costs outpacing benefits.

- Half of retirees are terrified of the impact tariff pricing changes will have on their retirement income or retirement savings; and

- More than 4 in 5 Americans are concerned about the long-term viability of Social Security.

Social Security’s modest benefits are further reduced by the rising costs of Medicare Part B premium payments that are deducted from most benefit checks.

This year, most retirees pay a $185 monthly premium. Based on the 2025 Medicare Trustees Report filed in mid-June, the monthly premium for Part B is projected to rise by 11.5 percent to $206.20 in 2026. It would be the eighth time in the last quarter century that the Part B premium has risen by a double-digit percentage on a year-over-year basis, as reported by The Motley Fool.

Medicare Part B covers items such as services from doctors and other health care providers (in-office or outpatient); preventive services like screenings, vaccines, or other shots; outpatient care; durable medical equipment like wheelchairs or walkers; and home health care.

With no end in sight for the federal government shutdown, partisan debates have emerged over future health care funding—particularly for families enrolled in the Affordable Care Act, known as ObamaCare. As America’s population continues to age, the future of Medicare funding also must be a part of that important debate—particularly when the Social Security Trust Fund is projected to run out of money by 2033.

Systemic, long-term improvements to Social Security and health care are in the best interests of the nation. Here’s hoping Congress will recognize and respond to this reality.

Charlene Crowell is a Senior Fellow with the Center for Responsible Lending. She can be reached at [email protected].