Legislative Update – July 2013

Budget Plans

Three weeks after the NC Senate approved a budget, the Republican majority in the state House voted 77-40 to adopt its own budget proposal. While both budgets spend $20.6 billion and differ on certain details, both slash taxes for the wealthiest corporations and individuals while raising them on working families and the poor.

The budgets also cut education funding, from pre-K through college, bringing NC’s school spending down to 46th in the nation, and teacher pay to 48th. Meanwhile, the middle class will shoulder most of the burden of tax increases as both budgets eliminate or diminish tax benefits for income-earners.

Listed below are some important effects of the proposed budgets:

El-Hi Education

• rejects pay raises for teachers

• eliminates raises for educators with advanced degrees

• eliminates teacher assistants in elementary schools

• changes eligibility requirements of Pre-K classrooms, leaving tens of thousands unable to qualify

• takes $50 million from public schools to use as vouchers for private and religious schools, including for-profit school corporations

Higher Education

• slashes community college funding by nearly $25 million

• cuts funding for UNC system by $47 million

Health

• rejects expansion of Medicaid services provided to middle class families

Economy

• defunds minority and community economic development initiatives

• eliminates regional development commissions

• centralizes economic development decision-making

Environment

• slashes Clean Water Management Trust Fund by $87 million

• weakens Green Building rules

Both the House and Senate bills cut teacher assistants, increase college tuition rates, close prisons and youth centers, and cut funding to the NC Biotech Center.

One Good Budget Item

One Good Budget Item

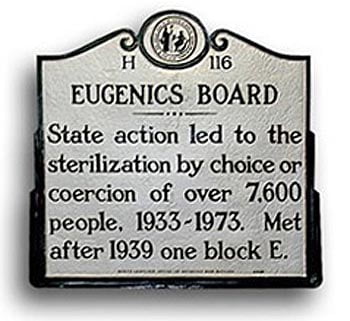

With bipartisan support, the House budget sets aside $10 million for the living victims of North Carolina’s Eugenics Board program. Each survivor will receive $50,000 in compensation for undergoing involuntary surgeries that left them unable to reproduce through the state-sponsored program from 1929 through the mid-1970s. Whether this line item will survive in conference remains to be seen.

Tax Reform

Both houses have also approved tax reform packages that will cost the state hundreds of millions in lost revenue by giving tax breaks to the wealthy and shifting the tax burden to the middle class.

The House would reduce the personal income tax rate – currently three rates topping out at 6.9 percent – to a flat 5.9 percent in 2014, while the Senate would reduce it to 5.25 percent in 2015; a family earning $25,000 per year would save under $100; someone with taxable earnings of a million dollars a year would pocket at least $10,000 in savings. Meanwhile, the House bill would completely eliminate the state’s Earned Income Tax Credit, which helps the working poor with the lowest state incomes.

The Senate plan eliminates all itemized deductions, such as mortgage interest and charitable contributions, which primarily benefit middle-class wage earners; the House would allow unlimited charitable contributions but caps mortgage deductions at $25,000. The House also keeps a 5.4 percent corporate income tax rate while the Senate gradually eliminates it over four years.

The Senate bill would also impose a state tax on Social Security checks for those with other income sources. Worried by the political repercussions of such a move, Senate leaders, in an unusual step, sent the bill back to committee while they seek a compromise with the House and Governor Pat McCrory.

The costs of such tax cuts for the richest NC residents are massive. The House bill would lose more than $500 million in revenue over the next two years, while the Senate bill would cost the state more than $850 million in the same period; by 2017-18 the Senate bill would lose $1.3 billion in state revenue

Installment Loans

Meanwhile, state lawmakers gave final approval to legislation that ramps up the cost of consumer finance loans, giving a free hand to out-of-state businesses that offer predatory “payday” loans to those with the most limited financial resources. Lobbyists spent more than $1.5 million to pass the bill. Many consumer groups have called on Governor McCrory – who opposed such loans when campaigning for reelection as Charlotte mayor – to veto the legislation.

Gun Bill Would End North Carolina Pistol Purchase Permits

The Senate Judiciary Committee added new language to a House bill expanding gun rights Tuesday morning to include doing away with North Carolina’s current system of pistol purchase permits. Under current law, North Carolinians must get a permit from their local sheriff’s office to buy a pistol. The restriction does not apply to rifles and shotguns.

The Senate addition to House Bill 937 would require a concealed weapons permit or a background check to buy a pistol – but no permit from a sheriff’s office. Records of concealed-carry permits issued and weapons sales would not be open to the public.

Unemployment Benefits

On July 1, 71,000 North Carolinians lost their unemployment benefits when Gov. Pat McCrory refused to accept the federal government’s offer to extend them. The benefits are 100% federally funded, and North Carolina, with the fifth highest unemployment rate in the nation, is the only state turning down the benefits.

Designed to help individuals who are laid off through no fault of their own, unemployment helps make ends meet while recipients are looking for work. State Representative Susan Fisher (D-Buncombe) called the decision to abruptly end benefits to vulnerable families “not only callous, but short-sighted.”

Because the benefits circulate locally when the unemployed spend them on needed services and products, “ending these benefits will cost our state about $20 million a week in lost consumer spending” – or a billion dollars a year.

Added Fisher, “Unemployment benefits can be the difference between making a mortgage payment and foreclosure. These benefits can be the difference between paying tuition for a child or having to pull them out of school. Our unemployed workers and their families deserve our support. Unfortunately our state is pulling their safety net out from under them instead.”