Is Homeownership Out of Reach for Asheville Residents?

By Sandra Kilgore, GRI, ABR, SFR –

Are you thinking about buying a home, but frustrated with the rising prices?

You are not alone. In fact 61% of renters believe home ownership, due to rising prices and low inventory, is only a dream.

With the average income of Asheville residents in the range of $28,106, and the average median household about $44,100, purchasing a home in Asheville may be a little challenging. One option to consider may be a condo or townhouse.

You probably have noticed the increase of rental apartments in the area. The average cost to rent a one, two, or three bedroom unit ranges from $950 to $1,650 per month. Although most of the developments are very nice, with upscale amenities, they do not offer you any of the benefits that come with owning a home.

Purchasing a condo or townhouse will provide you with the benefits of ownership. This a great place to start to build equity that can be used towards your dream home. In fact, qualifying for a mortgage may be easier than qualifying to rent in some of those rental communities.

One concern that buyers have about condos are the association fees. When you consider what the fees cover, most of the time you are getting a deal. Many of the fees cover things such as the insurance, water, trash, pest control, and upkeep of the exterior and common areas. In fact, it is possible to own a condo or townhouse, including maintenance and taxes, for less than $1,000 per month.

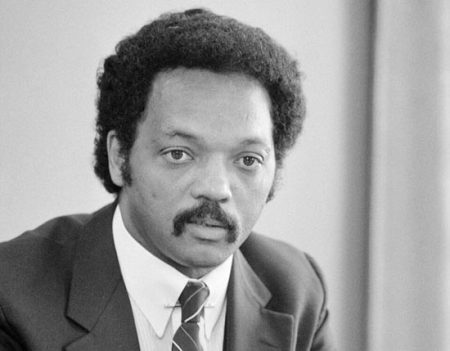

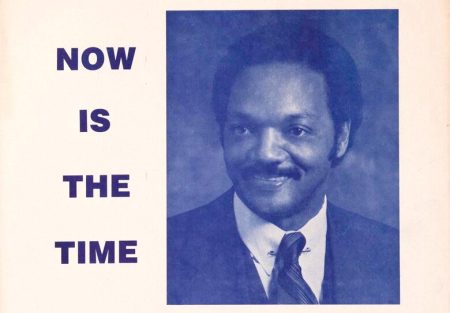

Sandra Kilgore GRI, ABR, SFR

Direct: 828-515-1588

Cell: 954-540-5593