Fixing Our Economy in a Few Easy Steps

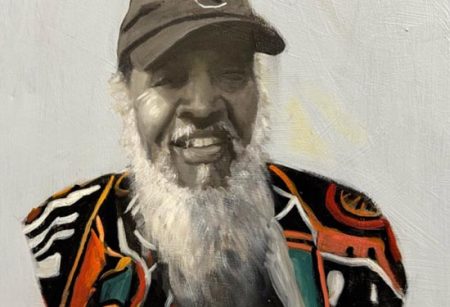

by Errington C. Thompson, MD

On Friday, August 3, the Bureau of Labor Statistics released July’s unemployment numbers. The rate was 8.3%. This is almost exactly the same as the 8.2% that we saw in May and June of this year. “Experts” were expecting the economy to add approximately 100,000 jobs; instead it added a net 163,000 jobs (even after subtracting for layoffs by state governments). There was much rejoicing on Wall Street.

I say, “Bah, humbug.” The economy still has a jobs hole somewhere around 9.7 million people. The number of Americans who are unemployed and underemployed is somewhere around 14 million. So, 163,000 jobs is a drop in the bucket.

For my money, I’m tired of politicians in Washington (and Raleigh for that matter) piddling around with the economy. We need jobs. We need jobs today. Politicians saying that we need to cut the deficit simply don’t understand the economy. If Congress decides to cut spending in order to pay down the deficit, these spending cuts equal a decrease in our GDP.

This means less money for construction. This means less aid to states, so teachers get laid off, firefighters get laid off, and police officers get laid off. When more people get laid off, demand for goods and services is depressed. Therefore there’s less tax revenue. With less tax revenue the government is less able to pay off its debts. It’s called a “vicious cycle, and it is a classic case of trying to cut off your nose to spite your face.

The economy needs to be jump-started. I would say that the economy needs another stimulus, but the word stimulus carries such a stigma I’m gonna stay away from it. Instead, I’ll offer up a few other ways to stimulate our economy.

Let’s start with the housing market. First, houses that have been on the market for more than a year or so and have stood empty for more than a year need to be torn down. The land should be offered at a reduced price to one of the neighbors. This will boost real estate prices in depressed neighborhoods. This will also take care of the problem of a housing glut in certain areas of the country.

Secondly, homeowners who are underwater really and truly need relief. We need an aggressive policy to keep Americans in their homes. I know that the Obama administration has the Making Home Affordable program, but the effort is halfhearted. Everyone is worried about moral hazard (encouraging people to buy homes who don’t have the money to afford it because they think they’ll be bailed out by the federal government). I am not. I’m worried about people who are unemployed or underemployed. I’m worried about our economy. We need to fix underwater homes.

I know that Solyndra is supposed to be the $500-million poster child for government run amok but it is not. Solyndra did fail with $500 million of American taxpayer money. The failure of one company does not weaken my resolve for renewable energy. Can you imagine a bank that threw in the towel because one business that it invested in failed? No bank would ever lend money again. We do need to figure out why Solyndra failed and take steps to avoid failure in the future.

For a number of reasons, we need to invest heavily in renewable energy. We need a $500-billion-dollar investment. As a matter fact, I would propose a $500 billion investment per year, every year for three years. Our economy generates $15 trillion per year. We’re trying to stimulate this economy by investing somewhere around 3% of our total GDP. We are trying to push unemployment rate down below 5%. Such a program would hire over 5 million Americans. Now we’re talking. This is a fix.

Next, we need to restore billions of dollars that have been cut in state aid. The states are laying off teachers, firefighters, and other public employees because they’re running out of money. For the most part, the states are not running out of money because they’ve poorly managed their finances; they have been hurt by the financial downturn.

With fewer people working, states are taking in significantly less tax revenue. The federal government needs to make up a lot of those funds. By some estimates over 600,000 state and local employees have been laid off over the last two years. We need the state and local governments to hire all of these Americans back.

Once we push the unemployment rate below 5% then we can readdress our deficit. In my opinion, if we aggressively tackle the unemployment problem, our economy will catch fire. The GDP will rise. Suddenly, our GDP to debt ratio will look much better. Then, paying down the debt will be as easy as pie (or is that pi)!